Case Study: SocialBets

A web application that brings digestible alternative data on social sentiment to retail investors.

Role

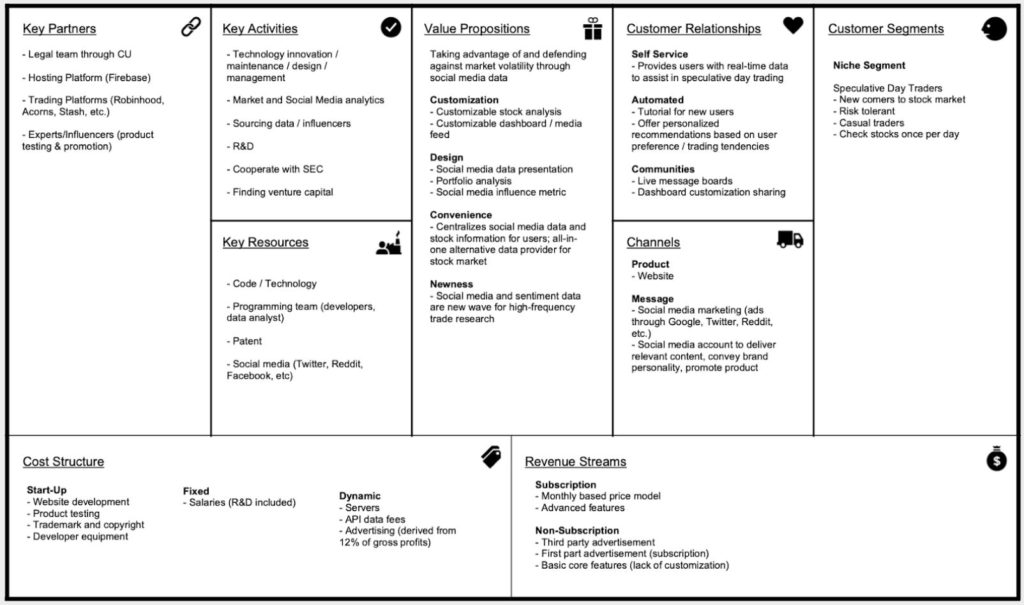

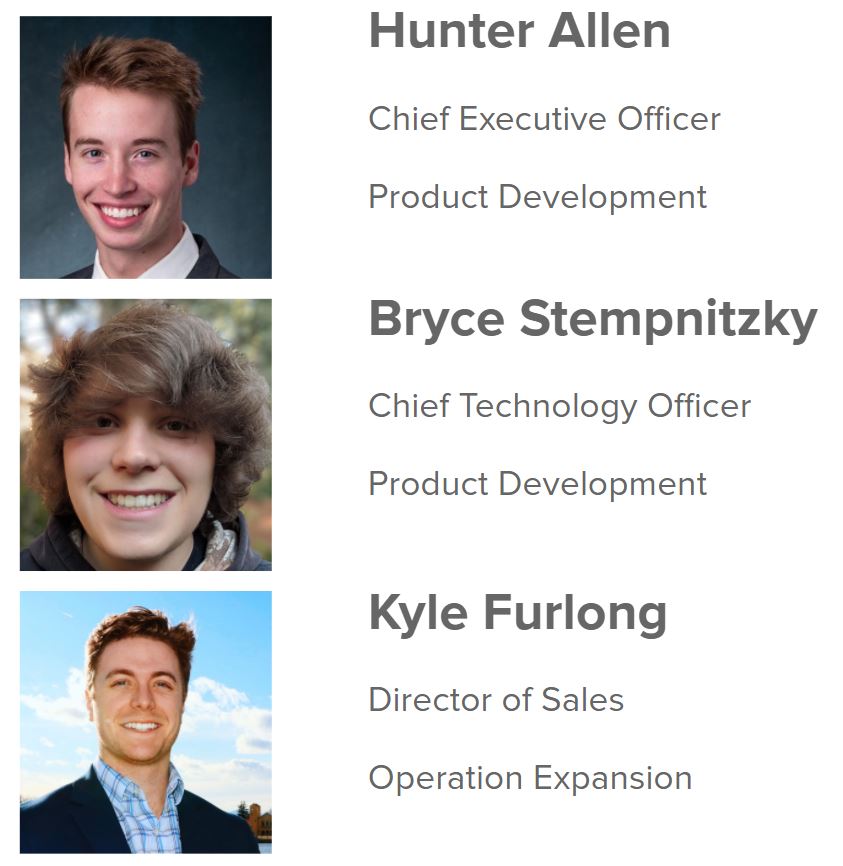

I led our team of three to come up with a business plan for SocialBets. My first priority was figuring out the strengths, weaknesses, and inclinations of my teammates to give them the most appropriate roles for them and our prospective business. I took up the position of CEO and distributed the roles of CTO and COO to my teammates. My responsibilities as CEO included but are not limited to the following: presenting pitch decks, practicing product management, conducting both industry and market research/interviews, and completing competition analysis.

Product

SocialBets provides users with an easy to use and accessible tool for gathering social media sentiment. Using SocialBets, users will be able to find the data they need to gauge social sentiment at a glance. Upon entering the website, subscribers will be shown their customized dashboard of data visualizations. This means that users can easily access real time social sentiment data on the stocks they are most interested in from the groups and users they trust the most. No more sifting through untrustworthy social media posts irrelevant to their trading style.

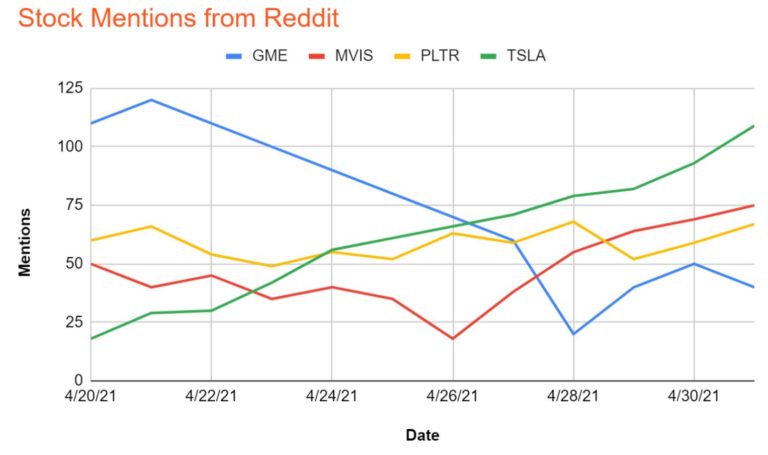

Below is an example of how SocialBets presents sentiment data. From a quick glance, one can see TESLA quickly become one of the main stocks mentioned on Reddit. Gamestop is in decline, and may be at the end of its rally. By studying the data in the graph below, one can extrapolate where a stock is and where it is going according to public opinion.

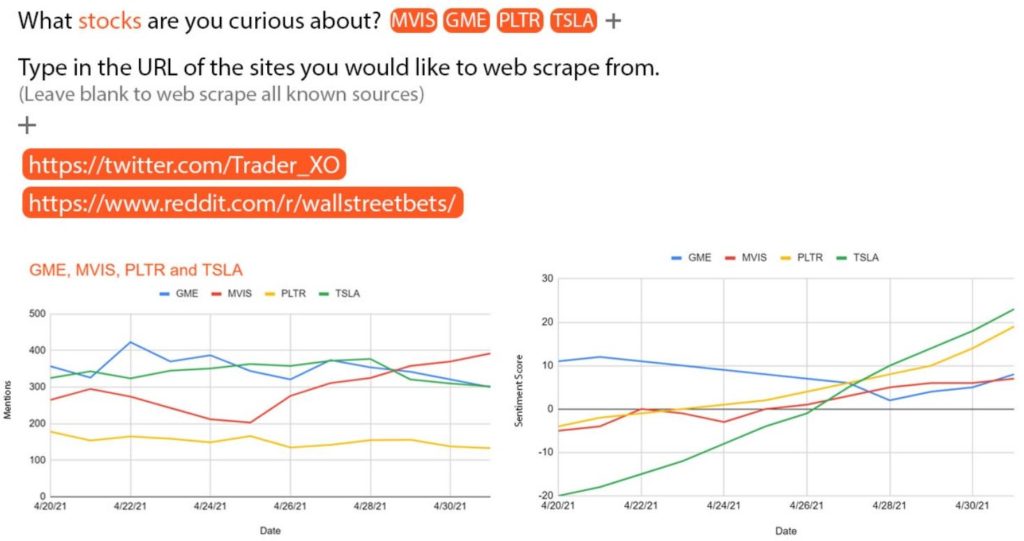

Going deeper than just counting up the mentions, our program will interpret the context of the mentions through machine learning. This way, it is possible to tell if people are preaching positive or negative thoughts towards a stock. The quality of what people are saying about a stock affects its “sentiment score”. The graphic below is an example of the UI someone would use to input the stocks they are interested in and the websites they want to webscrape from.

Process

The idea of SocialBets began in the wake of the GameStop phenomenon, where retail investors rallied together against the hedge funds who were heavily short selling GameStop. Through this coordination, they rose the stock price almost 8,000%.

We needed to learn more about the behavior and mentalities of retail investors before developing the business. To deeply understand our potential market, we interviewed several retail investors to learn about how they invest. Specifically, we wanted to dive into the struggles and ideal outcomes of their stock research.

The value proposition revealed itself through the discovery interviews. To get a better handle on the industry, we analyzed the landscape by finding competition, inspiration, and potential partners. We interviewed industry leaders and alternative data specialists. We also utilized databases like Statista to find out more about market size and market growth for alternative data. These databases gave us big data samples on the kind of people that actively use financial apps, helping us narrow our target market.

We then started conducting framing interviews, where we would give myriad stock data (including social sentiment) to participants and observe how they would process the data. We also gave mockups of how the app would present data to see how we could make the design more intuitive. Lastly, the framing interviews gave us the chance to discuss potential additional features of the app with many retail investors directly.

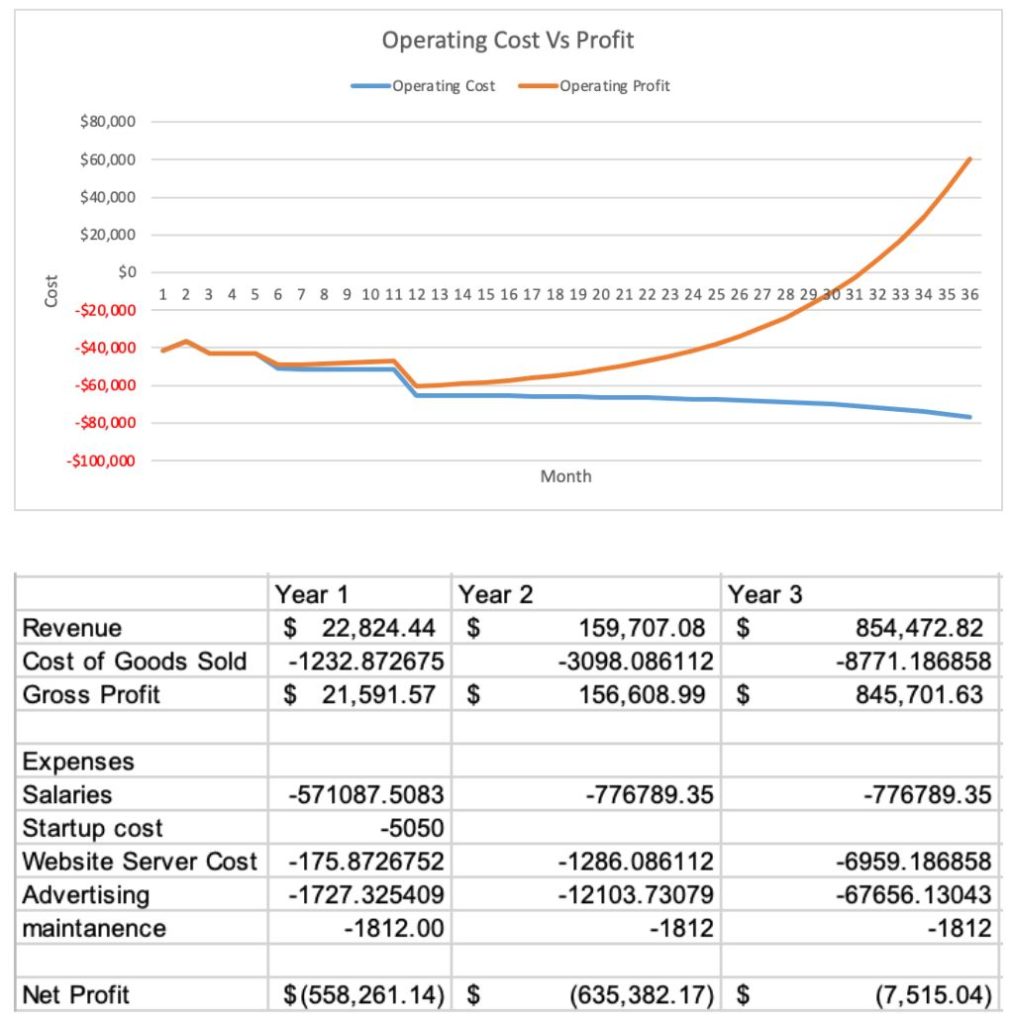

Lastly, we made dynamically adjustable financial models. This revealed the most important drivers to our business, our break-even point, and how much money we would have to raise to start the business. Using numbers that were carefully harvested through our research, we felt confident in projecting our financial model up to three years in the future.

Key Takeaways

We spent months ideating, researching, and polishing a purely hypothetical business plan. There is so much a team can do to prepare for a business venture. There is no excuse for not having external data to back up any business decision. While the seed of an idea can come from personal experience, the unbiased product manager or entrepreneur looks to the real world for outside evidence to support their decisions. Ideas are fine, but they are basically meaningless and useless until they are developed.

Nothing is set in stone. Something that I felt confident about in the beginning ended up being something we had to come back to and change because the data from our research showed us otherwise. The landscape itself is changing as well. Time will keep moving forward, and you do not want to miss the wave of opportunity. This means that it is ok to put out incomplete products and then continue to build on them during the wave.

Twist the knife. To really get people invested in your ideas, you have to make them care. Make your audience feel the pain your business is relieving. While the product might not be geared towards the people you are presenting to, the skillful manipulation of the natural human trait of empathy can make an outsider take somebody else’s problem very seriously.

The CEO (or product leader) better be able to pitch their product effectively. If the CEO cannot convince people, then nobody can. The leader should also be somewhat familiar with every aspect of the business, even if they specialize in none of it. The CEO needs to trust the other leaders of the business to bring their more focused expertise to the table when something specific is in question.

Hunter Allen-Bonney | Product Manager